Everything about the Candlesticks by Best Trading Forex Platform-Xtream Forex

A candlestick is a sort of price chart utilized in technical analysis that shows the high, low, open, and shutting costs of security for a particular period. It began from Japanese rice vendors and dealers to follow market costs and everyday energy many years before getting promoted in the United States. The wide piece of the candle is known as the "genuine body" and tells financial backers whether the end cost was higher or lower than the initial value.

The candlestick's shadows show the day's

high and low and how they contrast with the open and close. A candlestick's

shape differs depending on the connection between the day's high, low, opening,

and shutting costs.

Candlesticks mirror the effect of financial

backer assumption on security costs and are utilized by specialized examiners

to decide when to enter and leave exchanges. Candlestick charting depends on a

method created in Japan during the 1700s for following the cost of rice.

Candlesticks are a reasonable strategy for exchanging any fluid monetary resource

like stocks, unfamiliar trade, and prospects.

Long white/green candlesticks show there is

solid purchasing pressure; this commonly demonstrates cost is bullish.

Notwithstanding, they ought to be taken a gander at with regards to the market

structure instead of independently. For instance, a long white candlestick is

probably going to have more importance if it structures at a significant value

uphold level. Long dark/red candles demonstrate there is critical selling

pressure. This proposes the cost is bearish. A typical bullish candlestick

inversion design, alluded to as a sled, structures when value moves

significantly lower after the open, at that point rallies to close approach the

high. The same bearish candlestick is known as a hanging man. These

candlesticks have a comparative appearance to a square candy and are frequently

utilized by brokers endeavouring to pick a top or base in a market.

The region between the open and the nearby is known as the real body, value trips above and beneath the genuine body are shadows. Wicks shows the most elevated and least exchanged costs of a resource during the period addressed. The body represents the opening and shutting exchanges.

The price range is the distance between the

highest point of the upper shadow and the lower part of the lower shadow travelled

through during the period of the candlestick. The range is determined by taking

away the low cost from the excessive cost.

On the off chance that the resource shut higher than it opened, the body is empty or unfilled, with the initial cost at the lower part of the body and the end cost at the top. If the resource shut lower than it opened, the body is strong or filled, with the initial cost at the top and the end cost at the base. Hence, the shade of the candle addresses the value development comparative with the earlier period's nearby, and the "fill" (strong or empty) of the light addresses the value course of the time frame in seclusion (strong for a higher open and lower close; empty for a lower open and a higher close). A dark (or red) flame addresses a value activity with a lower shutting cost than the earlier candlestick nearby. A white (or green) candle addresses a higher shutting cost than the earlier lights nearby. By and by, any tone can be appointed to rising or falling value candlesticks. A candlestick need not have either a body or a wick. By and large, the more extended the body of the candlestick, the more extraordinary the trading. In exchange, the pattern of the candlestick outline is basic and frequently appeared with colors.

Candlesticks can likewise show the current

cost as they're shaping, regardless of whether the cost went up or down

throughout the time expression and the value scope of the resource canvassed in

that time. Instead of utilizing the open, high, low, and close qualities for a

given time stretch, candles can likewise be built utilizing the open, high,

low, and close of a predefined volume range (for instance, 1,000; 100,000; 1

million offers for every candlestick).

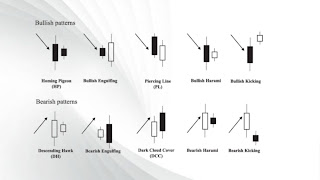

Two-Day

Candlestick Trading Patterns

There are some momentary trading procedures

dependent on candlestick designs. The immersing design proposes a potential

pattern inversion; the primary candle has a little body that is overwhelmed

constantly candle. It is alluded to as a bullish immersing design when it shows

up toward the finish of a downtrend, and a bearish overwhelming example at the

finish of an upturn. The harami cross is an inversion design where the

subsequent candle is contained inside the principal candlestick and is inverse

in shading. A connected example, the harami cross has a second candlestick that

is a Doji; when the open and close are successfully equivalent.

Three-Day

Candlestick Trading Patterns

A night star is a bearish inversion design

where the main candlestick proceeds with the upswing. The subsequent candle

holes up and has a thin body. The third candlestick closes underneath the

midpoint of the primary candle. A morning star is a bullish inversion design

where the main candlestick is long and dark/red-bodied, trailed by a short

candle that has gapped lower; it is finished by a since a long time ago bodied

white/green candle that closes over the midpoint of the primary candle.

Comments

Post a Comment